It’s Tax Season!

File your 2025 taxes for free.

You could be eligible for thousands of dollars in state and federal tax credits.

Filing a Tax Return Unlocks Cash - Get Free Help Online or in Person

You may be able to get free help from a trained tax preparer. You can also file your taxes online for free using GetYourRefund.

How can I file my taxes for free?

Free In-Person Tax Preparation

Have your taxes prepared for you in person, for free.

Appointment and walk-in options

Services provided by IRS-certified tax preparers

File Online with GetYourRefund for Free

Have your taxes prepared for you online, or file them yourself and get help when you need it.

File online at your convenience

Mobile-friendly

Live chat available to answer your questions

Services provided by IRS-certified tax preparers

What money could I get?

-

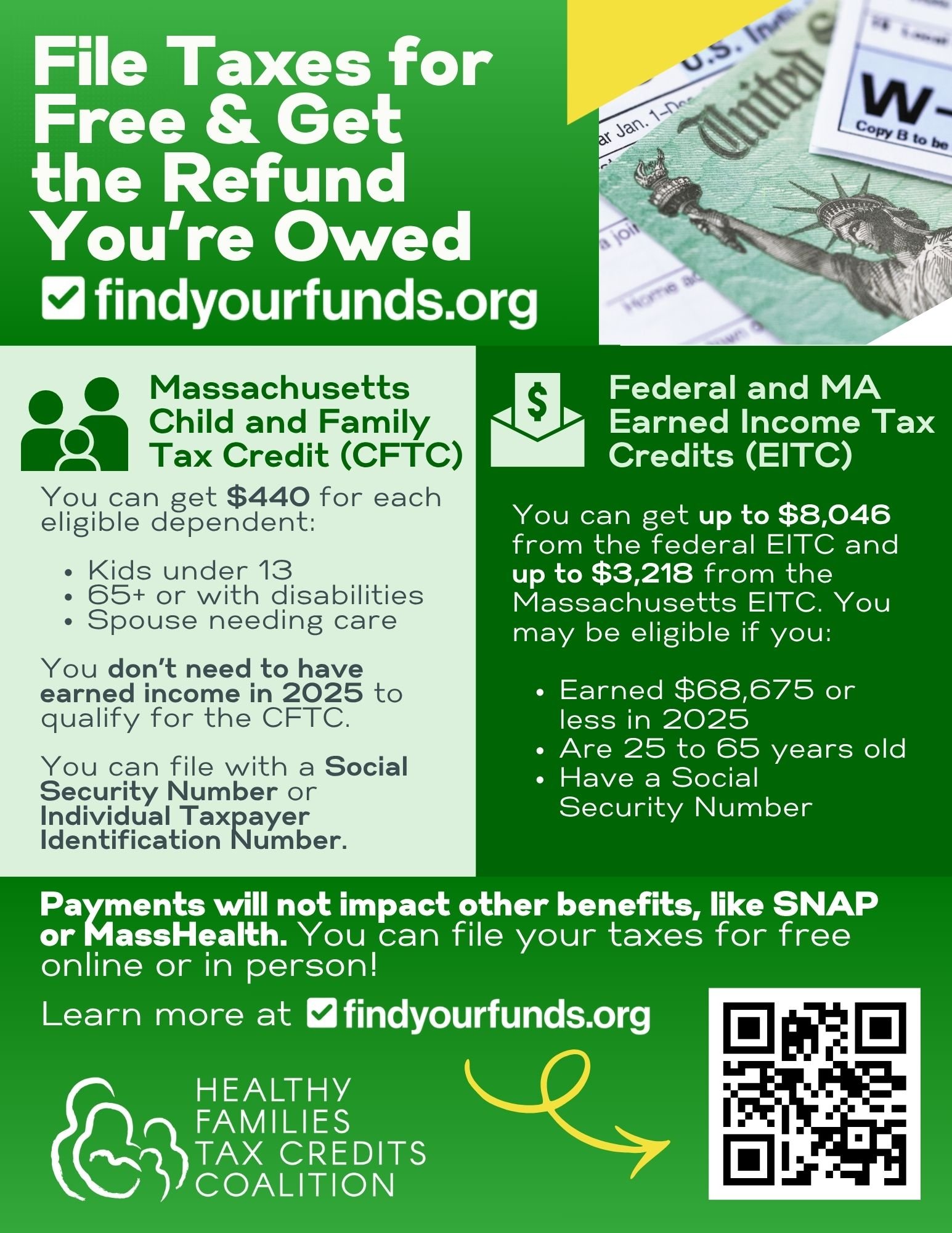

The Massachusetts Child and Family Tax Credit helps Massachusetts residents who care for a child or dependent. You can get $440 for each eligible dependent.

To get the MA CFTC, you must:

Care for:

a child under the age of 13,

a disabled dependent or spouse, or

a dependent 65 or older.

Dependent does not need a Social Security Number or ITIN to qualify. Learn more about the Massachusetts Alternative Taxpayer Identification Number.

File taxes with either a Social Security Number or an Individual Taxpayer Identification Number (ITIN).

You can get this credit even if you had no or very low income in 2025.

Learn more about the Massachusetts Child and Family Tax Credit.

-

The Massachusetts State Earned Income Tax Credit is for tax filers who qualify for the federal Earned Income Tax Credit. Like the federal credit, it is refundable, meaning you can get a cash refund even if you do not owe any tax.

The Massachusetts Earned Income Tax Credit is 40% of the federal Earned Income Tax Credit, up to $3,218 depending on income and family size. You can get this credit even if you had no or very low income in 2025.

Learn more about the Massachusetts Earned Income Tax Credit.

-

If you are 65 or older and have high housing costs, you could get up to $2,820 from the Massachusetts Senior Circuit Breaker Credit.

To get the credit, you must:

Own or rent a home in Massachusetts and live in it as your primary residence.

You can’t get the credit if you have a rent subsidy (live in subsidized housing).

Be 65 or older by the end of 2025.

Meet the 2025 Massachusetts Adjusted Gross Income (AGI) limits:

Up to $75,000 if you are single.

Up to $94,000 if you are head of household.

Up to $112,000 if you are married filing jointly.

To get the credit, file a Schedule CB Circuit Breaker Credit Form with your Massachusetts tax return.

Additional rules:

If you own your home: Your Massachusetts annual property taxes plus half of your annual water and sewer costs must be more than 10% of your total Massachusetts income in 2025. Your home’s assessed value must be below $1,298,000.

If you are a renter, 25% of your annual Massachusetts rent must exceed 10% of your total Massachusetts income for the tax year.

-

The Child Tax Credit helps many parents or caregivers. You can get up to $2,200 for each eligible dependent.

To get the Child Tax Credit, you must:

Have earned at least $2,500 from work in 2025

Have a Social Security Number, or file jointly with someone who has a Social Security Number (only one parent/filer needs an SSN).

Qualifying children must be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew). Additionally:

The child lived with you for more than half of 2025.

The child has a Social Security Number

The child was under 17 at the end of 2025.

You claim the child as a dependent on your tax return,

-

The Earned Income Tax Credit is for workers with low to moderate income. You can get up to $8,046. The amount depends on income and family size.

To get the Earned Income Tax Credit, you must:

File taxes with a Social Security Number.

Have income from work in 2025 under $68,675.

Have below $11,950 in income from investments in 2025.

If you are single without any dependents, you must have been aged 25 through 64 at the end of 2025.

Frequently Asked Questions

-

Most people who live and work in the U.S. have to file federal and state tax returns.

Whether you need to file depends on how much income you earned by the end of the year and your tax filing status (ex. Single/Married filing Jointly/Head of Household).

If you were self-employed and earned over $400 in net income (your gross earnings minus business expenses), you have to file regardless of your filing status.

See the IRS website for more information about filing obligations.

Don’t leave money on the table!

Even if you are not required to file and owe no tax, you may still want to file a tax return to get a refund:

if your employer withheld too much tax from your pay, and/or

if you are eligible to claim refundable* tax credits such as the Earned Income Tax Credit or the Child Tax Credit.

(*Some tax credits lower your tax liability if you owe tax, but a “refundable” tax credit generates a cash refund even if you do not owe any tax.)

-

These forms report income earned during the year:

W-2 or a corrected W-2 show your wages from employers.

W-2G for lottery and gambling winnings

1099 forms show other types of income. The most common are:

1099-K for payments from payment cards and online marketplaces

1099-G for government payments such as unemployment benefits

1099-INT from banks and brokers showing interest you received

1099-DIV for dividends and distributions paid to you

1099-NEC for freelance and independent contractor work in the gig economy

1099-R for retirement plan distributions or pensions or annuities

SSA-1099 for Social Security benefits

1099-MISC for other miscellaneous income

1095-A, Health Insurance Marketplace Statement, lets you reconcile advance payments or claims

-

There is no catch! Free tax filing is available in-person and online through the Volunteer Income Tax Assistance (VITA) program and GetYourRefund.

To file your taxes with VITA, you must meet one of these requirements:

Earned $69,000 or less in 2025

Have a disability; or

Limited English proficiency

To file your taxes online through GetYourRefund, you must meet these requirements:

File myself: Earned $84,000 or less in 2025; File with online support: Earned $69,000 or less in 2025

English or Spanish proficiency

Computer access

-

Tax credits lower the amount of tax you have to pay. Some tax credits can even give you money back, even if you don’t owe taxes or didn’t earn any income in 2025.

There are tax credits from both the federal government and the state. Each tax credit has different eligibility rules.

Massachusetts Tax Credits:

Massachusetts Child and Family Tax Credit (MA CFTC)

The Massachusetts Child and Family Tax Credit helps Massachusetts residents who care for a child or dependent. You can get $440 for each eligible dependent.

To get the MA CFTC, you must:

Care for:

a child under the age of 13,

a disabled dependent or spouse, or

a dependent 65 or older.

Dependent does not need a Social Security Number or ITIN to qualify. Learn more about the Massachusetts Alternative Taxpayer Identification Number.

File taxes with either a Social Security Number or an Individual Taxpayer Identification Number (ITIN).

You can get this credit even if you had no or very low income in 2025.

Learn more about the Massachusetts Child and Family Tax Credit.

Massachusetts Earned Income Tax Credit (MA EITC)

The Massachusetts State Earned Income Tax Credit is for tax filers who qualify for the federal Earned Income Tax Credit. Like the federal credit, it is refundable, meaning you can get a cash refund even if you do not owe any tax.

The Massachusetts Earned Income Tax Credit is 40% of the federal Earned Income Tax Credit, up to $3,218 depending on income and family size. You can get this credit even if you had no or very low income in 2025.

Learn more about the Massachusetts Earned Income Tax Credit.

Massachusetts Senior Circuit Breaker Credit

If you are 65 or older and have high housing costs, you could get up to $2,820 from the Massachusetts Senior Circuit Breaker Credit.

To get the credit, you must:

Own or rent a home in Massachusetts and live in it as your primary residence.

You can’t get the credit if you have a rent subsidy (live in subsidized housing).

Be 65 or older by the end of 2025.

Meet the 2025 Massachusetts Adjusted Gross Income(AGI) limits:

Up to $75,000 if you are single.

Up to $94,000 if you are head of household.

Up to $112,000 if you are married filing jointly.

To get the credit, file a Schedule CB Circuit Breaker Credit Form with your Massachusetts tax return.

Additional rules:

If you own your home: Your Massachusetts annual property taxes plus half of your annual water and sewer costs must be more than 10% of your total Massachusetts income in 2025. Your home’s assessed value must be below $1,298,000.

If you are a renter, 25% of your annual Massachusetts rent must exceed 10% of your total Massachusetts income for the tax year.

Learn more about the Senior Circuit Breaker Credit.

Federal Tax Credits:

Federal Child Tax Credit (CTC)

The Child Tax Credit helps many parents or caregivers. You can get up to $2,200 for each eligible dependent.

To get the Child Tax Credit, you must:

Have earned at least $2,500 from work in 2025

Have a Social Security Number, or file jointly with someone who has a Social Security Number (only one parent/filer needs an SSN).

Qualifying children must be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew). Additionally:

The child lived with you for more than half of 2025.

The child has a Social Security Number

The child was under 17 at the end of 2025.

You claim the child as a dependent on your tax return,

Learn more about the Child Tax Credit.

Federal Earned Income Tax Credit (EITC)

The Earned Income Tax Credit is for workers with low to moderate income. You can get up to $8,046. The amount depends on income and family size.

To get the Earned Income Tax Credit, you must:

File taxes with a Social Security Number.

Have income from work in 2025 under $68,675.

Have below $11,950 in income from investments in 2025.

If you are single without any dependents, you must have been aged 25 through 64 at the end of 2025.

-

No! Federal and Massachusetts tax credits do not affect your eligibility for programs like SNAP, WIC, MassHealth, SSI, TAFDC, EAEDC, housing or child care.

-

Claim tax credits by filing a 2025 tax return by April 15, 2026. If you have not filed a tax return for previous years, it might not be too late! Speak with a VITA site representative today.

You can file taxes online using a smartphone or computer, or in-person for FREE.

-

No. Please see our Information for Immigrants section for more.

-

Yes! You can file your state and federal taxes from a previous year for up to three years after the original due date (usually around April 15).

Your tax fling process will depend on whether you are filing a tax return for the first time, or you are amending a return. Either way, first gather documents about income you’ve received for the tax year you are filing for. Also, if you received any notices from the IRS, have those ready.

If you did not file taxes for a prior year, you will need to file all tax forms (including any schedules) for that year. You will file these forms in the same way as a regular, on-time return. Learn more about filing prior-year taxes.

If you filed taxes during a prior year but did not claim a tax credit, you will need to file what is called an amended return by filling out Form 1040X, “Amended US Individual Income Tax Return” for each year. If you are claiming an eligible child for tax credits, you will also need to include the Schedule EIC (for the EITC) or Schedule 8812 (for the CTC) when you file each amended return. You should not amend a return until after the IRS has processed your original tax return.

Information for Immigrants

Most immigrants who live and work in Massachusetts are required to file tax returns with the IRS and the Massachusetts Department of Revenue. If you do not yet qualify for a Social Security Number, the IRS issues an alternative number called ITIN to allow you to file tax returns. ITIN stands for Individual Taxpayer Identification Number, and the IRS has issued them since 1997.

Are there risks to filing income taxes?

In April of 2025, the IRS signed an agreement with the Department of Homeland Security (including ICE) to share taxpayer information (such as name and address) for immigration enforcement. Do not rely on this site for legal advice. Whether you need to file and need an ITIN, or have an ITIN and want to file, consult with an immigration attorney if you have concerns about the privacy of your tax information.

For assistance, email taxbenefits-help@gbls.org or call (617) 371-1234 for the low income taxpayer clinic.

More Help

For other tax problems, such as disagreements with IRS about your refund or owing taxes, you may be able to get free legal help from one of the following programs. If you didn’t file your taxes in previous years, you may be eligible to receive tax credits you did not claim.

-

Asian American Civic Association Low Income Taxpayer Clinic

To set up an appointment:Call (617) 426-9492 ext. 285

Phone hours are 10:00 AM – 4:00 PM, Monday - Friday

Email: litc@aaca-boston.org

-

GBLS Low Income Taxpayer Clinic

To set up an appointment:

Call:

Main office: (617) 371-1234

Cambridge office: (617) 603-2700

Email: litc-intake@gbls.org

-

Harvard Law School Tax Clinic:

To set up an appointment:Call 617-384-0750 and leave a message

The clinic will return your call as soon as possible

-

Northeast Legal Aid Low Income Taxpayer Clinic

To set up an appointment:

Call (978) 458-1465

Phone hours are 9:00AM - 1:00PM, Monday - Friday

Other Resources

-

There are several ways to get food help

Food Benefits

Apply for SNAP food benefits online, by phone at (877) 382-2363 (press 7), by mail or fax, or at your local DTA office.Food Source Hotline

If you are facing hunger right now, contact the Project Bread FoodSource Hotline at 800-645-8333.Extra Nutrition for Women, Infants, and Children (WIC)

If you are pregnant or have children under 5, call (800) 942-1007 or find a WIC location near you.

Food Programs for Elder and Disabled People

Meals at locations throughout Massachusetts or home-delivery of meals to people who are 60 or older and certain people with disabilities. Call (800) 243-4636 or click here to find the nearest program.

-

There are available cash benefits, if you have no or very low income

Families with children and some pregnant people who have very low or no income may be able to get TAFDC cash benefits. Apply for TAFDC online, or by calling or going to your local Department of Transitional Assistance (DTA) office.

Adults 65 or older, or people with disabilities who have extremely low or no income, may be able to get EAEDC cash benefits. Apply for EAEDC online, or by calling or going to your local DTA office.

-

There is funding available to help you stay in your home

You may be eligible to receive help with current or past due rent, mortgage, and utilities. Reach out today by calling 2-1-1.

Fuel assistance is available for renters or homeowners, using any kind of heat (oil, gas, electric, etc.).

To learn more and apply, visit https://www.toapply.org/MassLIHEAP

-

MassHealth

MassHealth provides health benefits and help paying for them to qualifying children, families, seniors, and people with disabilities living in Massachusetts.

Certified Application Counselors

In Massachusetts, the CAC program is a joint program administered by MassHealth and supported by the Massachusetts Health Connector

CACs help people:

Apply for insurance benefits

Enroll in health plans

Maintain health insurance coverage

ConnectorCare (Health Connecter Plans)

ConnectorCare plans offer great coverage with important benefits like doctor visits, prescription medications, and emergency care. ConnectorCare plans have low monthly premiums, low co-pays, and no deductibles. There are different ConnectorCare Plan Types, which are based on your income. All of the plans offered for each Plan Type will have the same benefits and co-pays for covered services.

ConnectorCare plans are offered by some of the leading insurers in the state. Depending on where you live, you may be able to choose from ConnectorCare plans offered by a variety of insurers.

2026 Outreach Materials Available Now!

Please use the materials below to share information with friends, family, or community members!

Email carley.ruemmele@bmc.org with any outreach-related questions

Interested in getting involved? Become a VITA volunteer! Email kwabenaayim@masscap.org for more information.